The Indian stock market, known for its dynamic nature, offers ample opportunities for investors seeking growth and returns on investment. Selecting the right shares to invest in is crucial for maximizing gains and managing risks effectively. In this article, we will delve into the top 5 shares to invest in India that have captured investors’ attention due to their growth potential, dividend history, and market presence. You may also learn what are the pros and cons of investing in these shares, let’s gain a brief understanding of the Indian stock market and the factors driving investment decisions.

What are the top 5 shares to invest in India?

Based on growth potential and ROI, the following shares have emerged as the Top 5 choices for investors in India are:

- Adani Power share

- Tata Power Share

- Tech Mahindra Share

- Suzlon Share and

- Drreddy Share

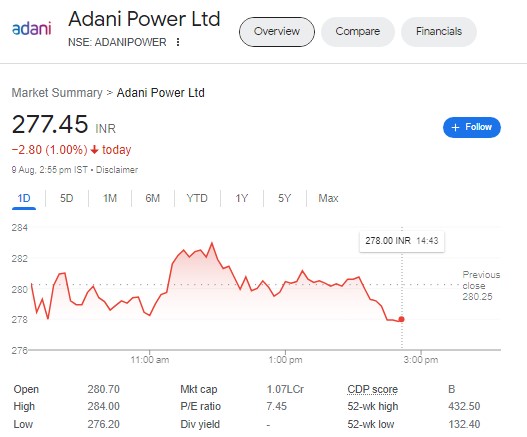

Share-1: Adani Power Share

1. Overview of the Adani Power company

Adani Power is a major player in India’s power sector. It operates thermal and solar power plants, contributing significantly to the nation’s energy requirements. The company’s strategic investments and innovative approaches have positioned it as a key player in India’s drive towards sustainable energy production.

2. Valuable information about Adani Power Share Price

|

Index |

Value |

|

Today Open (On 09/08/2023) |

280.70 |

|

Today High |

284.00 (+3.30) |

|

Today Low |

276.20 |

|

52 Weeks High |

432.50 |

|

52 Weeks Low |

132.40 |

|

P/E Ration |

7.45 |

|

Market Cap |

1.07LCr. |

3. Pros of investing in Adani Power Share

- Strong Demand for Energy: The consistent demand for power in India ensures a stable revenue stream for Adani Power.

- Renewable Energy Transition: The company’s commitment to renewable energy aligns with India’s push towards sustainable practices.

- Strategic Expansion: Adani Power’s expansion plans indicate potential for growth, both domestically and internationally.

4. Cons of investing in Adani Power Share

- Regulatory Changes: The power sector is subject to regulatory changes that could impact the company’s operations and profitability.

- Environmental Concerns: Adani Power’s reliance on thermal power plants raises environmental concerns amid growing emphasis on clean energy.

Also Read : How to Find Which Dell Laptop is Best with Price

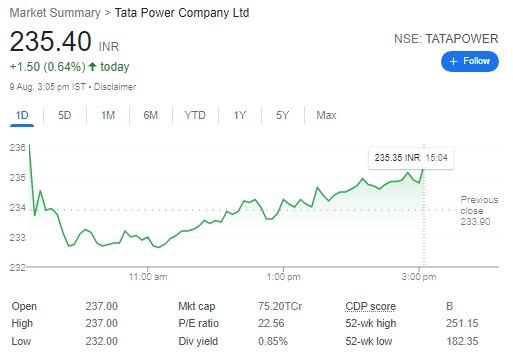

Share-2: Tata Power Share

1. Overview of the Tata Power company

Tata Power is a renowned integrated power company in India. With a diverse portfolio spanning generation, transmission, distribution, and trading of electricity, Tata Power plays a significant role in meeting the nation’s energy needs.

2. Valuable information about Tata Power Share Price

|

Index |

Value |

|

Today Open (On 09/08/2023) |

237.00 |

|

Today High |

237.00 |

|

Today Low |

232.00 |

|

52 Weeks High |

251.15 |

|

52 Weeks Low |

182.35 |

|

P/E Ration |

22.56 |

|

Market Cap |

75.20TCr. |

3. Pros of investing in Tata Power Share

- Diversification: The company’s presence across various segments provides a diversified revenue stream.

- Renewable Focus: Tata Power’s investments in renewable energy align with global trends and government initiatives.

- Brand Reputation: Tata Power’s longstanding reputation and ethical practices contribute to investor trust.

4. Cons of investing in Tata Power Share

- Regulatory Challenges: Changes in regulations could impact the company’s operations and profitability.

- Market Fluctuations: The power sector can be influenced by macroeconomic factors, impacting Tata Power’s financial performance.

Also Read : Top 10 Certifications in Computer Science for High Salary in 2023

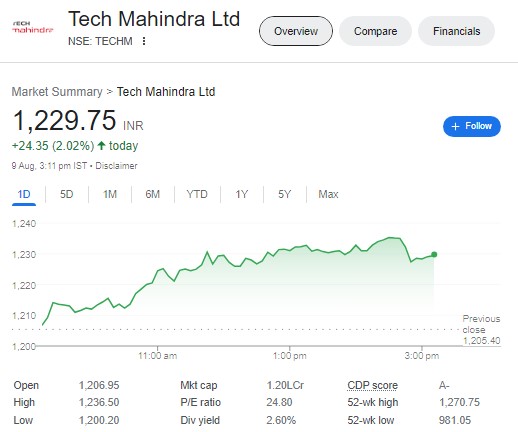

Share-3: Tech Mahindra Share

1. Overview of the Tech Mahindra company

Tech Mahindra is a leading IT services and consulting company, catering to a wide range of industries including telecommunications, healthcare, and finance. It has a global presence and is known for its technological innovations.

2. Valuable information about Tech Mahindra Share Price

|

Index |

Value |

|

Today Open (On 09/08/2023) |

1206.95 |

|

Today High |

1236.50 |

|

Today Low |

1200.20 |

|

52 Weeks High |

1270.75 |

|

52 Weeks Low |

981.05 |

|

P/E Ration |

24.80 |

|

Market Cap |

1.20LCr. |

3. Pros of investing in Tech Mahindra Share

- Technology Trends: Tech Mahindra’s expertise in cutting-edge technologies positions it well for growth in a digitally driven world.

- Global Reach: The company’s international presence diversifies its revenue sources and reduces dependency on a single market.

- Client Relationships: Strong client relationships and industry partnerships enhance Tech Mahindra’s competitive advantage.

4. Cons of investing in Tech Mahindra Share

- Market Competition: The IT industry is highly competitive, and Tech Mahindra faces challenges from both domestic and international players.

- Cybersecurity Risks: As a technology company, Tech Mahindra is vulnerable to cybersecurity threats, which could impact its reputation and operations.

Also Read : Which HP Laptop is Best with Price

Share-4: Suzlon Share

1. Overview of the Suzlon company

Suzlon Energy is a prominent player in the renewable energy sector, specializing in wind power generation. It has a strong global presence and has contributed significantly to India’s renewable energy goals.

2. Valuable information about Suzlon Share

|

Index |

Value |

|

Today Open (On 09/08/2023) |

18.95 |

|

Today High |

19.50 |

|

Today Low |

18.90 |

|

52 Weeks High |

20.80 |

|

52 Weeks Low |

6.60 |

|

P/E Ration |

43.81 |

|

Market Cap |

24.29TCr. |

3. Pros of investing in Suzlon Share

- Renewable Focus: Suzlon’s focus on renewable energy aligns with global environmental trends.

- Global Expansion: The company’s international operations offer growth opportunities beyond the domestic market.

- Wind Energy Demand: The increasing demand for wind energy presents a favorable market for Suzlon.

4. Cons of investing in Suzlon Share

- Market Volatility: The renewable energy sector can be influenced by changes in government policies and market dynamics, affecting Suzlon’s performance.

- Operational Challenges: Suzlon’s operations are subject to challenges related to project execution, maintenance, and regulatory compliance.

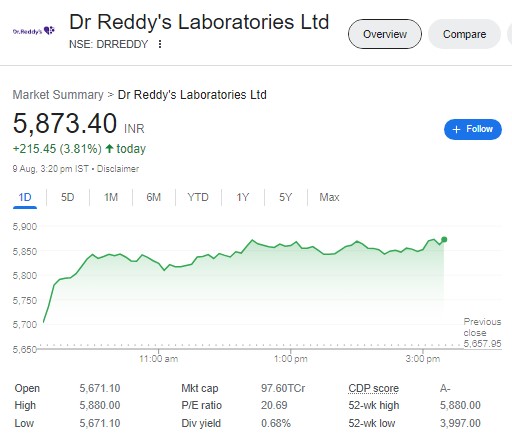

Share-5: Drreddy Share

1. Overview of the Drreddy company

Dr. Reddy’s Laboratories is a pharmaceutical company known for its research, development, and production of generic medicines. It operates in multiple therapeutic areas and has a global footprint.

2. Valuable information about Drreddy Share Price

|

Index |

Value |

|

Today Open (On 09/08/2023) |

5671.10 |

|

Today High |

5880.00 |

|

Today Low |

5671.10 |

|

52 Weeks High |

5880.00 |

|

52 Weeks Low |

3997.00 |

|

P/E Ration |

20.69 |

|

Market Cap |

97.60TCr. |

3. Pros of investing in Drreddy Share

- Global Pharmaceuticals: Dr. Reddy’s global presence provides exposure to diverse markets and regulatory environments.

- Research and Innovation: The company’s focus on research and innovation drives its competitive advantage and product pipeline.

- Healthcare Demand: The pharmaceutical industry’s consistent demand offers stability to Dr. Reddy’s revenue.

4. Cons of investing in Drreddy Share

- Regulatory Challenges: The pharmaceutical industry is subject to strict regulations that can impact product approvals and market access.

- Patent Expiry: Dr. Reddy’s faces challenges related to patent expirations and generic competition, affecting its market share.

Also Read : How to make money with Reselling business

Conclusion

Choosing the right shares for investment requires a comprehensive understanding of the companies, their industry dynamics, and market trends. The top 5 shares discussed – Adani Power, Tata Power, Tech Mahindra, Suzlon, and Dr. Reddy’s – each offer unique opportunities and challenges. However, investing in the stock market involves risks, and it’s crucial to carefully assess the pros and cons of each investment. Investors are advised to conduct thorough research, consider risk factors, and consult financial experts before making investment decisions.

Disclaimer

The information provided in this article is for informational purposes only. It should not be considered as financial advice. Readers are encouraged to consult with financial advisors or experts before making any investment decisions.

FAQs

-

What criteria were used to select the top 5 shares?

The top 5 shares were selected based on their growth potential, historical performance, market presence, and relevance to current market trends.

-

Are these shares suitable for long-term investment?

Each share has its own potential for long-term growth. Investors should assess their risk tolerance and investment goals before making a decision.

-

How can I mitigate risks associated with investing in the stock market?

Diversification, thorough research, staying updated with market trends, and consulting financial experts are effective ways to mitigate risks associated with investing in the stock market.

-

How can I monitor the performance of these shares over time?

Monitoring the performance of shares involves tracking financial news, market reports, and company announcements. Many financial platforms provide real-time data and insights for investors.

-

How do I start investing in these shares?

To start investing in these shares, you’ll need a demat account and a trading account with a reliable brokerage. It’s important to research different brokers, understand their fees, and choose one that suits your needs.